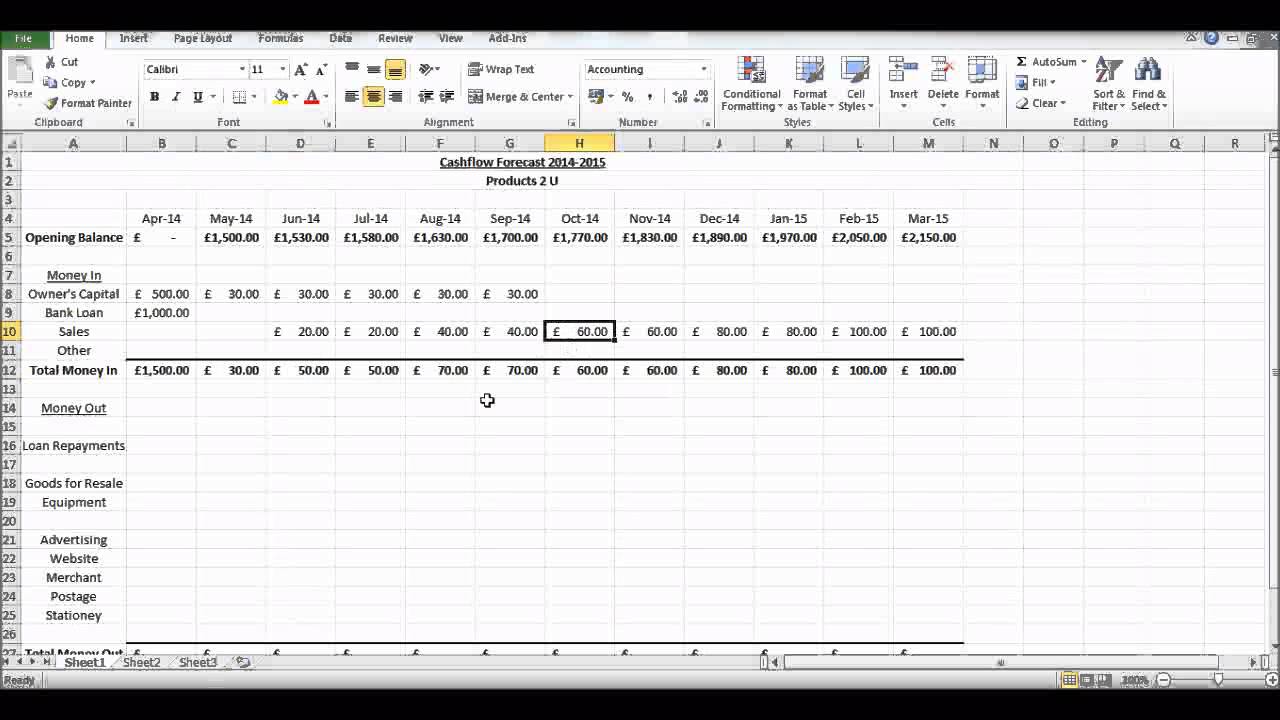

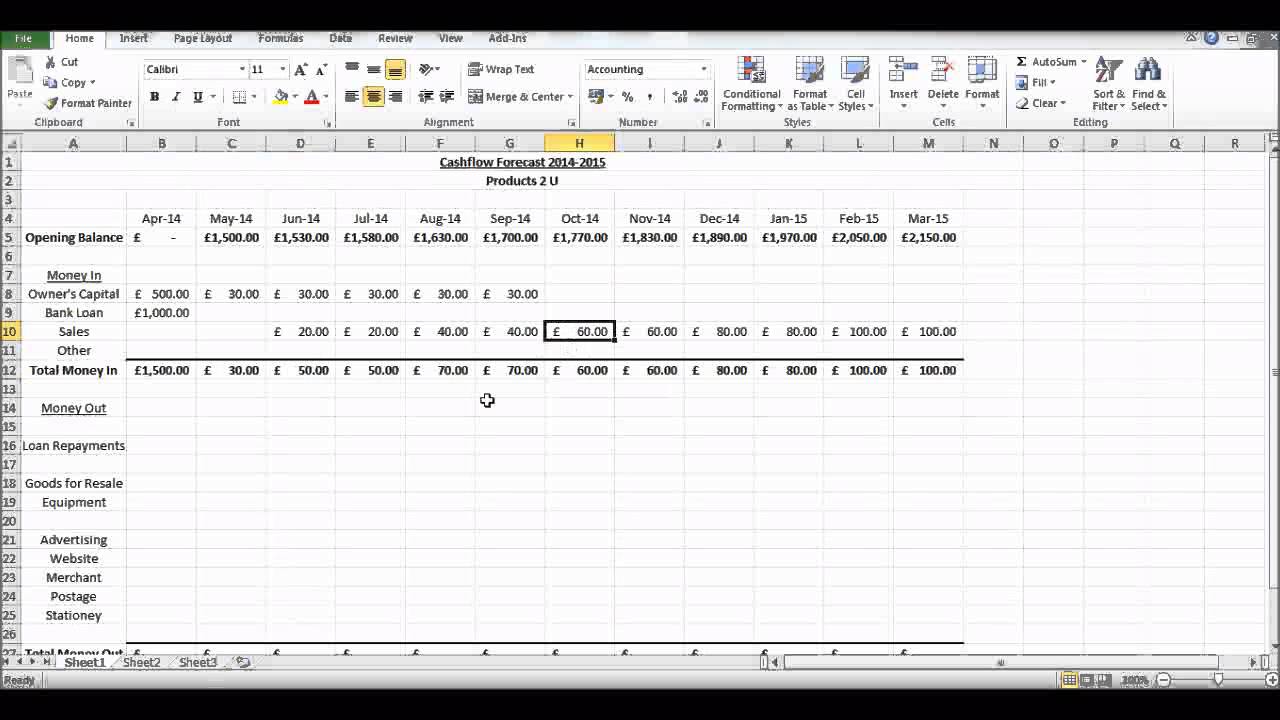

So now your cash flow forecast shows you how much income you expect, and when you expect to receive that income you need to estimate your outgoings. Once your estimated sales are in place, you need to add in when you expect payments to be received.Īs you probably know, you’ll need to factor a delay for most payments (most payments are usually 2 weeks late). Things to consider include any promotional activity or product launches, and the activity of competitors too. Take a look at the current state of the market and any emerging trends, as these may have an impact on your business. When estimating these sales, it’s important to take any future plans into consideration too. If you’re just starting your business, then you can use data from suppliers, industry experts and even competitors to make predictions. Take note of any seasonal patterns, or the impact of promotions you have run in those months. The easiest way to do this is to look at your sales history from the last few years. To start, you need to estimate your likely sales for the weeks or months covered by your cash flow forecast.

There are three key elements to include in a cash flow forecast: your estimated likely sales, projected payment timings, and your projected costs. What should be included in a cash flow forecast? This means that its liabilities exceed its assets, unless its ongoing revenue covers its debt obligations. With some effective cash flow forecasting, however, things shouldn’t get to that stage. If a business runs out of cash (and can’t get a loan or funding) it will become insolvent. You can also run best and worst case scenarios to see how your business will cope in difficult times, or what you’d be able to afford to do if trading is better than projected. If you can predict any cash surpluses or shortages on the horizon, you’ll be able to make more informed business decisions.

Running hypothetical business changes through your cash flow forecast is a great way to predict their impact. If you’re planning on hiring, for example, you can add the salary and related costs to see how it’ll affect your business’s financial position.

Be adapted to see the effects of planned business changes. Help you budget for equipment purchases or identity the need for a small business loan, which is very useful for your tax preparation. By comparing your actual income and expenses with your forecast, you can see which areas of your business are over or under performing and act accordingly. Show you whether your business is meeting expectations. Why use a cash flow forecast?Ĭash flow forecasts are primarily used to help the business owners plan how much cash they’ll need in the future. Cash flow forecasts typically cover the next 12 months, but can also be used for shorter periods of time – like a week or a month. It also includes your projected income and expenses. A cash flow forecast is a document that helps estimate the amount of money that’ll move in and out of your business. It can then make changes if necessary.Understanding your cash flow is vital for your business and forecasting plays an important role in your finances. They will also need to monitor the business’ cash flow carefully to see whether their estimates were realistic, and make changes if not.Īn established business can compare its actual cash flow with its cash flow forecast to monitor whether it is achieving its targets. This will require the entrepreneur to make some guesses. Calculating and monitoring cash flowĬreating a cash flow forecast for a new business can be difficult, as the business will have no previous figures to help it estimate its future cash inflows and outflows. It can therefore assist the business in making important decisions, such as:Ĭash flow forecasting can also help a business to identify the risks of negative cash flow. businesses with unpredictable sales patterns, for example seasonal businesses (eg an ice cream van)Ī cash flow forecast allows a business to plan for the future. Forecasting cash inflows and outflows is important, especially for three types of business: A cash flow forecast will usually be for a 12-month period. Calculating and interpreting cash flow forecastsĬash flow is the movement of money in and out of a business over a period of time.Ĭash flow forecasting involves predicting the future flow of cash in and out of a business’ bank accounts.

0 kommentar(er)

0 kommentar(er)